Angola’s central bank will hold an auction on Tuesday to sell foreign currency to commercial banks, its first since saying it will abandon a dollar peg, according to three people familiar with knowledge of the matter.

The kwanza will probably be allowed to depreciate at the auction as the central bank shifts to a trading band, the people said, asking not to be identified because they aren’t authorized to speak publicly on the matter. About $100 million of foreign currency will be offered at the auction, one person added.

Angola, Africa’s second-largest oil producer, will join a long list of commodity exporters — from Russia to Egypt, Kazakhstan, Nigeria and Uzbekistan — that have floated or devalued currencies in a bid to end crippling shortages of foreign exchange and revive economic growth. The kwanza has been fixed at 166 against the dollar since April 2016, but trades at 430 per dollar in the black market.

“There will be an exchange-rate adjustment with the kwanza losing about 15 percent of its value against the dollar,” said Tiago Dionisio, a Lisbon-based analyst for Eaglestone Advisory SA. “Once that adjustment happens, I expect the kwanza to trade between 190-210 per dollar in the foreseeable future.”

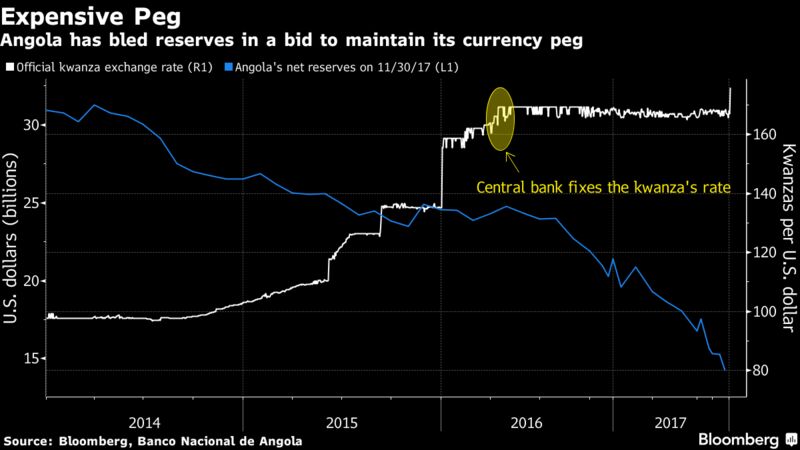

Dwindling Reserves

Central bank Governor Jose Massano said last week that the country’s dwindling foreign-exchange reserves triggered the end of a peg that “does not reflect the truth.” Reserves dipped to $14.2 billion in November from $15.4 billion in October, and are down from $20 billion at the start of 2017, according to the central bank.

The kwanza will “clearly face” depreciation pressure in the upcoming auctions, Sonja Keller and Yvette Babb, strategists at JP Morgan Chase & Co., said in a research note Friday. “Despite a 65 percent devaluation against the dollar in the year to June 2016, the kwanza has become increasingly overvalued,” Keller and Babb said.

The results of the foreign-currency auction will probably be made public on Wednesday, the people said.

“It’s obvious that there will be a gradual depreciation of the kwanza at these auctions,” said Kaan Nazli, a strategist at Neuberger Berman Europe Ltd. in The Hague, which manages almost $300 billion, including Angolan Eurobonds. “I wouldn’t be surprised if the currency would lose 20 to 30 percent of its value against the dollar over the next year.”

Bloomberg